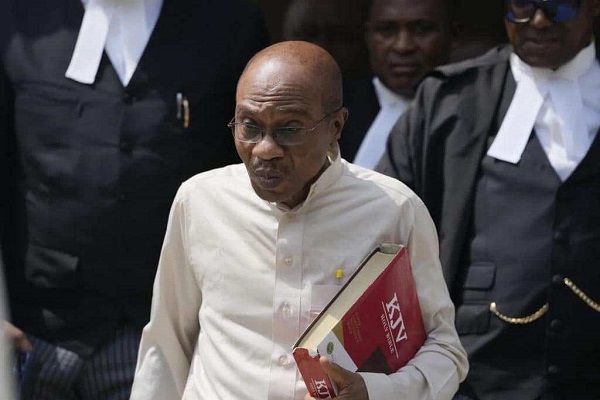

A former Director of Information Technology of the Central Bank of Nigeria (CBN), Mr. John Ayoh, has explained how he collected $600,000 allegedly for contract gratification for the embattled ex-apex bank governor, Mr. Godwin Emefiele.

Ayoh, while being led in evidence by the Economic and Financial Crimes Commission (EFCC) counsel, Mr. Rotimi Oyedepo (SAN), on Monday, April 29, told an Ikeja Special Offences Court that he spent eight years in the apex bank.

He told the court that he received a letter from the agency concerning two transactions which he facilitated through Emefiele.

Ayoh, Head of Procurement and Support Services (PSS) Department, told the court that the first envelope containing $400,000 was brought to his house in Lekki while he received the second envelope containing $200,000 at the Tinubu Head Office of the CBN.

Ayoh said he was vested with powers to receive applications for award of contracts to select successful bidders.

According to him, the first leg of the transaction was at his residence in Lekki Phase One while the second envelope money he received occurred at the Tinubu Head Office of the CBN.

He said: “The man to deliver the second transaction came to our office in Lagos and I informed the governor but he said he did not want to see a third party that I should bring the envelope myself.

“I complied with the instruction and went to his office and delivered it. Mr John Adeola was the one I sent my address to and he came to my house. He is the governor’s assistant and the total money I received on his behalf was $400,000 and $200,000, respectively.”

The witness informed the court that the vendors who allegedly brought the envelopes with money were in charge of the implementation of Netapp Storage Architectural and Infrastructural Services.

While under cross-examination by the first defence counsel, Mr. Olalekan Ojo (SAN), he told the court that his schedule of duties did not include running errands for Emefiele but he directly worked under him.

Ayoh confirmed to the court that Emefiele was not a member of the PSS but a member of the Major Contract Tender Committee (MCTC).

He added that he had never facilitated in the commission of any crime.

Ojo asked if the witness wrote in his statement that he was forced to aid or abet the commission of accepting gratification.

The witness said: “I do not remember the exact word that I used and I did not write in my statement that I opened the two envelopes on the two occasions to check the total sum of money.

“I wrote a statement and it implied that the money in the envelopes was given to me to influence the award of contract. I did not take part in the decision of the MCTC but I recommended that the award be given and I was not bribed.

“I was invited by the EFCC on February 17, I was not arrested but I returned home on administrative bail.”

The witness told the court that he operated under duress, while he received the two envelopes from the contractors.

“On your honour, did you indicate in your statement that you were acting under duress while running errands for the first defendant,” the learned silk asked.

The prosecution, however, objected to the question and argued that the statement of the witness was not before the court.

The first defence counsel sought that the statement of the defendant be admitted into evidence.

Justice Rahman Oshodi, thereafter, admitted the statement of the witness (three pages) into evidence, following arguments and counter arguments of the counsel.

The Senior Advocate reteirated that the witness showed to the court where it was written in his statement that he acted under duress.

The witness told the court that the instructions from Emefiele indicated that he bent rules.

The judge, thereafter, adjourned the case until May 3 for continuation of cross-examination.

Emefiele’s counsel also pleaded with the court to release the defendant to him on self-recognition because he had not met with his bail application.

The learned silk, however, prayed the court that the defendant would meet up before May 17.

There was no objections from the second defence counsel and the prosecution left the decision at the discretion of the court.

Society6 years ago

Society6 years ago

Society3 years ago

Society3 years ago

Society3 years ago

Society3 years ago

News and Report5 years ago

News and Report5 years ago

News and Report6 years ago

News and Report6 years ago

News and Report5 years ago

News and Report5 years ago