•EFCC gets order to freeze 300 accounts, says one account transacted $15bn illegally

•Naira would have crashed massively if 300 accounts were not frozen – Chairman

The Economic and Financial Crimes Commission may prosecute 300 forex racketeers trading on a peer-to-peer platform outside the financial regulations.

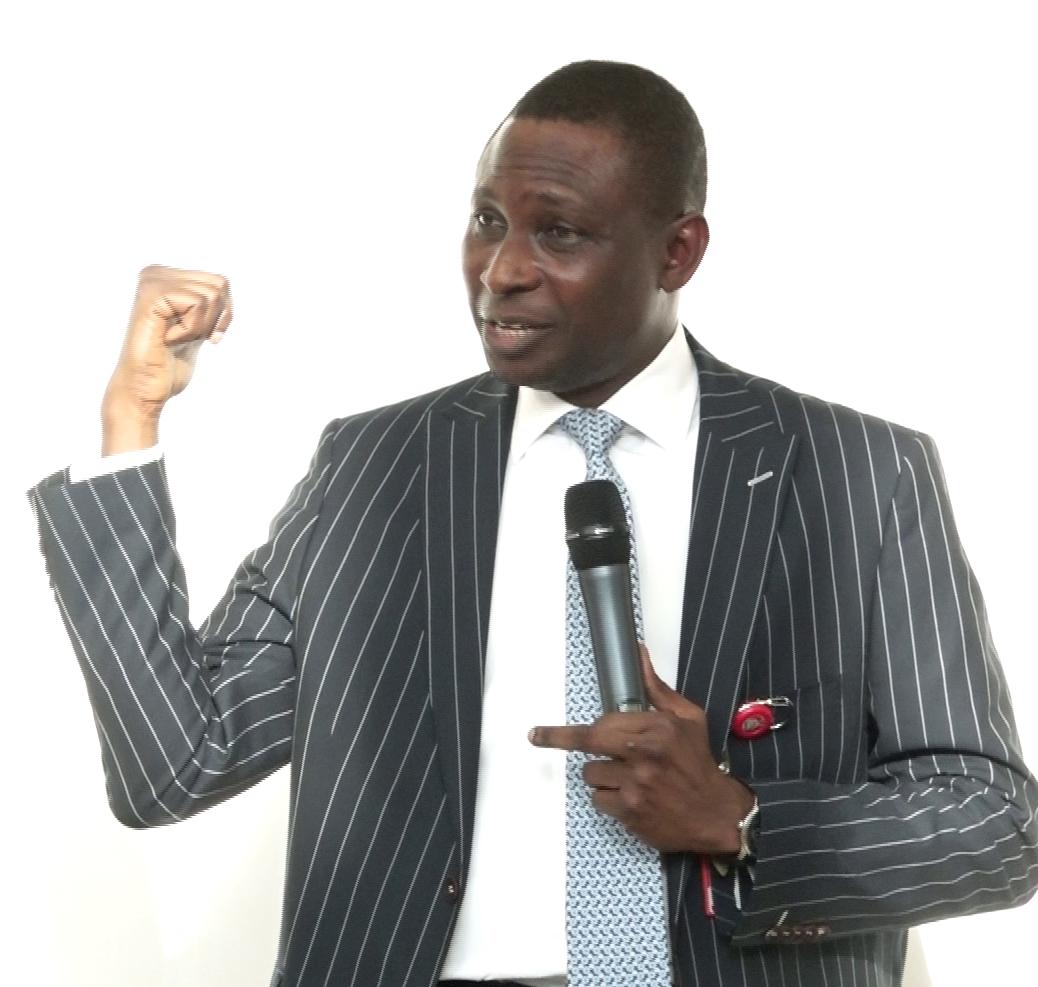

The EFCC Chairman, Ola Olukoyede, who gave this indication during an interactive programme with editors and bureau chiefs in Abuja on Tuesday, revealed that the accounts were frozen following a court order on Monday.

He disclosed that one of the accounts traded over $15bn in the past year.

Recently, the Federal Government through the Nigerian Communications Commission blocked the online platforms of Binance and other crypto firms to avert what it considered continuous manipulation of the forex market and illicit movement of funds.

It also detained two senior executives of Binance, a cryptocurrency exchange amidst efforts by the government to rein in speculation on the naira by cracking down on cryptocurrency exchanges.

The government also sent EFCC operatives to arrest Bureau De Change operators at the popular Wuse Zone 4 in Abuja.

While the websites of Binance, Coinbase, and Kraken have been inaccessible in the country, reports said crypto traders now use alternatives like Bybit, Bitget, Kucoin, and Coincola and messaging platforms like Telegram which comes with an in-app wallet to make transactions.

But highlighting the measures being taken to protect the naira and stimulate the economy, Olukoyede explained that the forex accounts were frozen to ensure the safety of the foreign exchange market and protect the economy.

He stated that the efforts had helped the value of the naira and the forex market.

He pointed out that the commission needed the support of Nigerians to succeed as he emphasised that if the agency failed, Nigeria had failed.

‘Worse than Binance’

Olukoyede stated, “We observe due process in whatever we do. Do you know that the Binance case we are currently handling now has helped us to bring down the madness in the forex market?

’Suddenly, we discovered that there are people in the system who are even doing worse than Binance. They called them P2P and all of that. We noticed in the last two days ago that dollars have started appreciating. There was stability for 24 hours, then the naira was devalued again by N20 and N25. I don’t know whether you noticed that.

“It was due to the activities of some of these guys on P2P platforms like coolcoin. Some of you must have seen them on social media. To shock you; just yesterday (Monday), I asked them to freeze over 300 accounts. We found that one of those guys (account owners), had traded over $15bn last year.’’

Continuing, the lawyer said 300 illicit accounts would have led to a crash of the naira in the next week if the EFCC hadn’t moved against them.

He added, ‘’Our job is serious. We work 18 hours per day. We are not saying that Nigerians should praise us because that was what we signed for but where we deserve, we should be given. We are humans like Nigerians.

“Over 300 accounts in illicit forex trading that would have led to another crash in the next one week if we didn’t move yesterday. Some people just want to see this country go from bad to worse. We must find a way to work together. We got an order to freeze those accounts; Imagine what would have happened if we didn’t seize those accounts.’’

The EFCC boss said his agency was focusing on illegal mining which he described as an economic crime.

‘Illegal miners’

He stated that EFCC operatives had recently intercepted 40 trucks of illegally mined lithium, promising to prosecute the perpetrators.

He also shed light on the current moves to arrest a former Kogi State Governor, Yahaya Bello, vowing to pursue the case to its logical conclusion.

Olukoyede vowed to resign as EFCC chairman if Bello was not prosecuted even as he declared that he would bring to book those who obstructed the arrest of the former governor.

The EFCC chairman vowed that everyone involved in obstructing Bello’s arrest from his Abuja residence would face the full wrath of the law.

He hinted that the incumbent Kogi State governor, Usman Ododo, accused of helping his predecessor to escape arrest, may be investigated for obstructing a lawful operation.

The EFCC is seeking to arraign Bello on 19 counts bordering on alleged money laundering, breach of trust and misappropriation of funds to the tune of N80.2bn.

Olukoyede said that no matter what anyone did or the amount of attack against the anti-graft agency, he and his men would not relent in helping to sanitise the country.

He revealed how he put a phone call across to Bello following the allegations of corruption brought against him.

Olukoyede said, “I called Yahaya Bello, as a serving governor, to come to my office to clear himself. I shouldn’t have done that. But he said because a certain senator had planted over 100 journalists in my office, he would not come.

“I told him that he would be allowed to use my private gate to give him a cover, but he said my men should come to his village to interrogate him.”

Olukoyede noted that the EFCC did not violate any law while trying to arrest the former governor from his residence.

“Rather, we have obeyed the law. I inherited the case and I didn’t create it. Why has he not submitted himself to the law?” he asked.

He added, “I have arraigned two past governors who have been granted bail now — Willie Obiano and Abdulfatah Ahmed.”

Speaking further, he said, “We would have gone after him since January but we waited for the court order. As early as 7 am, my men were there; over 50 of them. They mounted surveillance. We met over 30 armed policemen there. We would have exchanged fire and there would have been casualties.

“My men were about to move in when the governor of Kogi drove in and they later changed the narrative.”

He vowed that all those who had dipped their hands in the nation’s coffers would be investigated and prosecuted.

“If I can do (Ex-Anambra governor Willie) Obiano, (Ex-Kwara governor) Abdulfatah Ahmed and Chief Olu Agunloye, my kinsman, why not Yahaya Bello?” Olukoyede noted.

He further revealed how the former governor withdrew $720,000 from the state’s coffers to pay his child’s school fees in advance.

Olukoyede noted that Bello wired the $720,000 from the state’s coffers through a Bureau de Change operator.

The EFCC boss, while expressing his dissatisfaction with the ex-governor for failing to honour the EFCC summons, said, “A sitting governor, because he knew that he was going, he removed money directly from government’s account to bureau de change, and used it to pay his child’s school fee in advance. Dollars, $720,000 in advance, in anticipation that he was going to leave the government house.”

He expressed dismay over the activities of internet fraudsters which he said was enjoying the support of some unscrupulous Nigerians.

According to him, banks in the country lost over N8 billion to internet fraud in 2022.

He said more than 71 per cent of companies operating in Nigeria were victims of cybercrime in 2022, adding that the anti-graft agency’s fight against internet fraud is about saving the nation’s future.

Olukoyede disclosed that the commission has created a cybercrime research centre where convicted internet fraudsters, known in local parlance as Yahoo Yahoo boys, will be trained to channel their knowledge to positive aspects of society.

The EFCC chair also said the agency is prosecuting two of its operatives for violating the agency’s code of conduct.

He said the commission has implemented some reforms to enhance its fight against corruption, including creating a directorate of fraud risk assessment/control and ethics/integrity.

Meanwhile, ex-governor Bello was on Tuesday served his charges through his counsel, Abdulwahab Muhammad (SAN) after Justice Emeka Nwite of the Federal High Court, Maitama, Abuja, ruled that the defendant should be served through his counsel, especially as he failed to appear before the court, yet again.

This was contained in a statement on Tuesday by the EFCC spokesman, Dele Oyewale.

The EFCC is prosecuting Bello alongside his Ali Bello, Dauda Suleiman and Abdulsalam Hudu on 19-count charges bordering on money laundering to the tune of N80.2bn

The commission’s attempt to arrest him last Wednesday at his Abuja residence failed as Bello refused to grant the operatives access to his residence or give himself up, leading to a stand-off which lasted for several hours.

He subsequently managed to escape the dragnet as he was allegedly helped by Governor Ododo who took him away in his car.

The EFCC declared him wanted while the Nigeria Immigration Service put him on its watchlist.

At Tuesday’s sitting, Bello’s counsel, Adeola Adedipe (SAN) prayed the court to quash the arrest warrant granted the commission against Bello, arguing that Tuesday’s substituted service to the defendant through Muhammad has invalidated the arrest warrant.

“The court is expected to do justice at all times. A warrant of arrest cannot be hanging on Bello’s neck when we are in this court. It appears to us that the defendant will not get justice because the court granted a warrant of arrest before service,” he said.

However, prosecution counsel, Kemi Piniero (SAN) in response, urged the court to decline hearing on any motion from Bello’s legal team until the defendant is physically present in court for his arraignment.

“The stage we are in now is to determine the whereabouts of the defendant. He cannot be in his house while the trial proceeds without him coming here to take his plea. My Lord, this is a criminal matter not a civil matter, he must come and take his plea.

‘’It is a matter of over N80 billion. All these applications by the defendant are to prevent his arraignment and frustrate the commencement of trial,” he said.

After hearing both counsels, Justice Nwite adjourned ruling on the defence’s application, seeking a revocation of the arrest warrant on Bello till May 10.

Society6 years ago

Society6 years ago

Society3 years ago

Society3 years ago

Society3 years ago

Society3 years ago

News and Report5 years ago

News and Report5 years ago

News and Report6 years ago

News and Report6 years ago

News and Report5 years ago

News and Report5 years ago