…Global co-operation needed to stem global depression

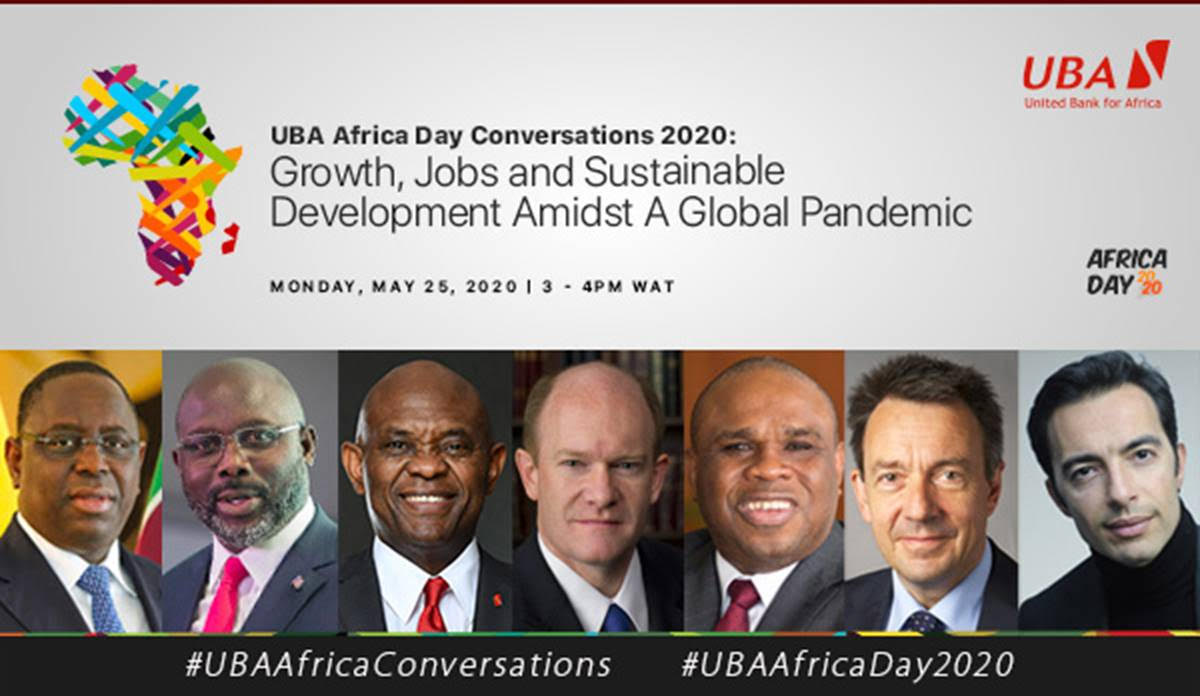

Global leaders at the second edition of United Bank for Africa (UBA) African Day Conversations, have emphasised the need for meaningful collaborations between governments and the private sector as a panacea for the quick recovery of the economy of the African continent post Covid-19.

The leaders which included the President of Liberia, H.E George Weah; United States Senator Chris Coons; the President & Chairman of the Board of Directors of the African Export–Import Bank (AFREXIMBANK), Professor Benedict Okey Oramah; President, International Committee of the Red Cross (ICRC), Peter Maurer; President spoke on Monday at the virtual Leadership Panel which was moderated by the Chairman, UBA Plc, Tony Elumelu.

Other leading voices who made up the panel were the Founder, Africa CEO Forum, Amir Ben Yahmed; the Secretary-General of the African Caribbean and Pacific Group of States (ACP), H.E George Chikoti; Administrator, United Nations Development Program (UNDP), Achim Steiner and Donald Kaberuka.

While moderating, Elumelu, who is also the Founder of the Tony Elumelu Foundation, spoke on the need to mobilise everyone and explained the necessity to discover a more fundamental solution to Africa’s challenges through collaborative efforts.

“This is the time for us to deal with the situation we have and also forge a better situation for everyone, acting again collectively,” he said. “This is not the time for finger pointing but for collaborative effort by governments and organizations to fight the pandemic globally.”

Continuing, Elumelu pointed out that all hands must be on deck if the African continent is to have a quick recovery from the pandemic, adding “There is need to flatten the curve, we need global co-operation to stem global depression. Africa requires a large stimulus package, and we need long-term solutions to prevent a cycle of debt.”

In his submission, the Liberian President, George Weah, established how collaborations worked in his government in an attempt to stem the sufferings brought about the coronavirus pandemic.

“In Liberia we have taken measures to ease the financial burden on vulnerable business in the informal sector by providing small loan assistance to SMEs and traders. In addition, we are working with commercial banks to manage the repayment of loans as well as to create stimulus packages for citizens.”

On his part, US, Senator Chris Coons, said, “It is important to take a moment to look at how African leaders have reacted to the pandemic. In order for us to recover from this pandemic, we must develop a vaccine that is free and affordable and freely distributed so that full economic activities can return. There are ways we can invest in debt relief, invest in infrastructure and human development. This is no time to be looking backwards. We recognise the power of collective collaboration on the continent.

While pointing out that the pandemic poses an opportunity for Africa to be independent and promote its growth and development as a people without external help; Prof. Benedict Okey Oramah, on his part, said COVID 19 has taught Africa that there comes a time when every group of people will fend for themselves.

He called for the swift implementation of the African Continental Free Trade Area (AfCFTA) agreement, adding, “The priority of government should be to make sure that the AfCFTA gets implemented without delay. If there was any doubt about the importance of that agreement, this pandemic has told us that this is the way to go.

Continuing, Oramah said, “The pandemic has shown so many weaknesses we have across our continent. We know that hunger is looming if we do not do anything. If we allow hunger to take over from the COVID 19 pandemic, we will begin to see political problems filling in. For Africa the problems go beyond health challenges to other areas such as food supply. Hunger is looming and if action is not taken, Africa will see political problem. Africa has become the epicenter of the economic devastation that this pandemic has unleashed upon us.”

While disclosing that Afrexim has made available $200million to supply fertilizers and grains amongst others across Africa, the Afrexim boss added that “If Africa allows hunger takeover the people, it will see an increase in insecurity, which will take a long time to overcome.”

George Chikoti of ACP, said that the huge task of economic recovery on the continent, rests on both the government and the private sector. “The responsibility of COVID-19 does not rest on the government alone, the private sector needs to play a big role in lifting the burden of the pandemic. African governments need to accept the support of the Private Sector in alleviating the impact of the COVID-19 pandemic in Africa,” he said.

“We have been able to release $25m to all member states. One of the major challenges is to make sure that in all countries, we have agricultural activity and high productivity. What we should learn from the impact of this pandemic is that the international community can look at how well they can fund all these initiatives that come from our countries, Chikoti added.

Achim Steiner of the UNDP noted that Digital connectivity is very essential as it is a crucial opportunity to connect all schools across the continent, adding that emphasis on Healthcare is also very important. “Digital connectivity is very crucial to connect schools to the internet. We need to address inequality; also, the virus has put a spotlight on Africa’s healthcare system. Africa needs to look at intermediate strategies like micro-insurance to ramp up this sector. Healthcare has the ability to make a large percentage of the occupation fall into extreme poverty.

“What we need to look at is to find a way for government as a regulator and also as an investor, to leverage private sector investment into these areas” Steiner said.

Peter Maurer, President, ICRC, said there is the need to look at pandemics as part of a broader health system which needs stabilisation; A lot of vulnerable populations in Africa have been heavily infected by the pandemic. “We must do more than life-saving. This pandemic has illustrated the weakness of health, water, sanitation and social systems, and we have to heavily invest into the stabilization of these systems.

Throwing more light on this, Maurer said, “Two things need to follow after live saving during the pandemic. First, the pandemic has illustrated the weak situation of health, water and food systems and we need to heavily invest both by the public and private sectors to stabilize the health sector. Secondly, investment has always gone into the more developed parts of Africa and not the fragile parts. We need Private Public Partnerships and investments by multi-corporate institutions to develop these areas’ he noted.

Amir Yahmed said the crisis is going to be a super accelerator of already existing trends. “We have to get away from the commodity driven model which has failed in creating prosperity. Secondly, self-reliance should be one of the major objectives. The pandemic is wake up call for Africa – Creating new streams of revenue and self-reliance by the African continent”

“We need to use this crisis to take Africa to the next level. This crisis is going to be a super accelerator of already existing trends. I think it has to be a wake-up call for us to attain goals we haven’t reached. Create new revenues for the economy. We also need to attain self-reliance. Self reliance is an important goal. Africa manufactures [only] 2% of what it produces. We need to use this crisis to take Africa to the next level. Invest in digital infrastructure, digital education, agriculture is another opportunity we need to grab. We need to get the AFCTA working,” Yamed said.

Donald Kaberuka on his part opined that “What we need (for this crisis) is something unusual, it is not business as usual. It is not marginal action, it is radical action.”

Society6 years ago

Society6 years ago

Society3 years ago

Society3 years ago

Society3 years ago

Society3 years ago

News and Report5 years ago

News and Report5 years ago

News and Report6 years ago

News and Report6 years ago

News and Report5 years ago

News and Report5 years ago