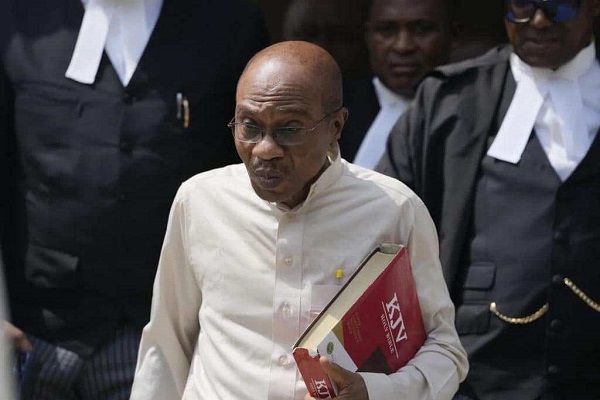

The Economic and Financial Crimes Commission (EFCC) on Monday arrested the Accountant-General of the Federation, Ahmed Idris, over alleged mismanagement of N80billion.

Idris was arrested on Monday in Kano and is currently being moved to Abuja.

“Operatives of the Economic and Financial Crimes Commission, EFCC, on Monday, May 16, 2022 arrested serving Accountant General of the Federation, Mr. Ahmed Idris in connection with diversion of funds and money laundering activities to the tune of N80billion (Eighty Billion Naira) only,” a statement by the agency read.

“The Commission’s verified intelligence showed that the AGF raked off the funds through bogus consultancies and other illegal activities using proxies, family members and close associates.

“The funds were laundered through real estate investments in Kano and Abuja. Mr. Idris was arrested after failing to honour invitations by the EFCC to respond to issues connected to the fraudulent acts.”

SaharaReporters had in a series of detailed investigations exposed how Idris acquired several properties whose values ran into many billions of naira since he was appointed by President Muhammadu Buhari as the administrative head of the treasury in June 2015.

A visit to Gezawa Commodity Market Limited and Gezawa Integrated Farms Limited owned by Idris lend credence to the allegations made by concerned citizens and some stakeholders on how and where the AGF got the money he used in acquiring the multi-billion naira firms, both in Kano through his direct family members.

The shareholdings of both firms indicate a spread of Idris family members on the official board.

Certified copies of the documents from the Corporate Affairs Commission seen by SaharaReporters showed that the shares for Gezawa Commodity Market Limited are distributed among the family members of the AGF as follows:

(1) Zainab Ahmed Idris: 35,000,000 shares

(2) Shamsiyya Ahmed Idris: 35,000,000 shares

(3) Nabila Mu’azu Abubakar: 35,000, 000 shares

(4) Zuhair Ahmad Idris: 22,500,000

(5) Hussain Ahmad Idris: 22,500,000 shares

(6) Abdulrraham Ahmed Idris: 22,500,000 shares

(7) Khadija Ahmed Idris: 18,500,000 shares

(8) Mua’zu Abubakar lll: 40,000,000 shares

(9) Mohammed Chiroma: 60,000,000 shares

(10) Alh Usman Kansila Yahaya: 60,000,000 shares

(11) Baloni Ibrahim Lawal (representing Silvermark Investment Limited) : 60,000,000 shares

(12) Abubakar Nabila Mua’zu (representing Gezawa Integrated Farms Limited) : 20,000,000 shares.

There have also been questions asked about how the AGF bought “Sokoto Hotel” in Kano with N500million cash.

SaharaReporters gathered that Idris upon acquiring the hotel, ordered its immediate demolition with the intention to build a multi-billion naira shopping mall on the property.

Despite clocking 60 years in 2020, Idris succeeded in pulling different strings in the Presidency to secure an extension of his appointment beyond the legal limit.

SaharaReporters gathered that he engaged the services of highly placed persons including governors, senators and emirs who prevailed on President Buhari to give him the extension.

The action is however against the civil service rules, which states that a career civil servant must disengage from service either after attaining 60 years of age or having worked for 35 years, whichever comes first.

It was also against a circular from the office of the Head of Service to all agencies of the Nigerian Government which says, “For avoidance of doubt and in order to maintain discipline and integrity of the extant public service rule which prescribed 60 years of age or 35 years of service for mandatory retirement, should strictly be complied with.

“Accordingly, the following guidelines shall apply. (I) that career officers who take up tenured appointment should at the point of taking up the appointment retire from service to ensure they run their term uninterrupted.

“(II) that career officers who have not retired from service before the commencement of their tenured appointment must leave office on attainment of mandatory age/years of service for retirement and (iii) that career officers who are currently holding tenured appointment are required to retire from service with immediate effect and continue to run their term. Failure to do so would mean that they would vacate office on attaining the mandatory age or at the expiration of their term whichever comes first.”

Idris’ arrest is also coming few months after he secretly married a 16-year-old Kano State girl, identified simply as Hussain.

SaharaReporters had in a string of reports revealed that despite Hussain’s family kicking against the wedding, Idris who turned 61 on November 25, 2021, insisted on marrying her.

“This is our late sister’s daughter by name Hussain; she’s just sixteen, not long that she clocked sixteen years old but it’s very unfortunate that a lady called Amina was the one that linked or brought the Accountant-General to our house in order to seek her hand in marriage.

“This, she did, knowing that this is a very young girl, what does that mean? It shows the accountant general is just after that small girl to take advantage of her youthful age.

“Immediately I heard, I messaged him because when I was working with the then Head of Service, I had the opportunity of having his contact when we met over a serious matter about the country. So I messaged him on WhatsApp regarding his wedding; I sent him my picture, that of my son, my late sister and the daughter, Hussain. He replied that it’s a small world which confirmed the wedding was true,” a top family source had confided in SaharaReporters.

The family source added that the Accountant-General bribed some media organisations they contacted for help and their request to expose his atrocities was therefore turned down.

“He went as far as bribing this girl with a gold of over N200million, iPhones, buying cars for her, giving her millions of naira – all to buy her attention. He started meeting different people that he wanted to know the girl’s family; he married the girl, just like that.

“There was no investigation just because he is the Accountant General of the Federation. Why are things happening in this country like this? He even told the girl to go and look for any house of her choice in Abuja, that he is ready to purchase it for her.

“He is spending the government money and every media house we go to report him, he pays them not to air or report the story. Please help us for justice to be done. This girl is just sixteen years old,” the source had added.

Society6 years ago

Society6 years ago

Society3 years ago

Society3 years ago

Society3 years ago

Society3 years ago

News and Report5 years ago

News and Report5 years ago

News and Report6 years ago

News and Report6 years ago

News and Report5 years ago

News and Report5 years ago