...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

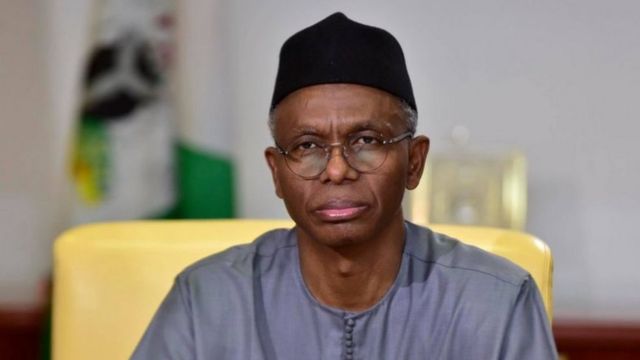

The immediate-past governor of Kaduna State, Mallam Nasir El-Rufai, has urged the Federal High Court in Kaduna to quash the report of the state House of Assembly indicting him of N432bn theft.

In a suit filed by his lawyer, A.U. Mustapha, on Wednesday, El-Rufai said the Assembly breached his right to a fair hearing by not inviting him in the course of the probe.

He is urging the court to declare the report of the Assembly’s ad hoc committee indicting it null and void.

El-Rufai’s media aide, Muyiwa Adekeye, disclosed the development in a statement on Wednesday.

Adekeye said, “Mallam Nasir El-Rufai was at the Federal High Court, Kaduna, today to sign the affidavit supporting his fundamental rights enforcement case against the Kaduna State House of Assembly and the Kaduna State Government.

“El-Rufai approached the court as a Nigerian citizen entitled to be given a fair hearing before his rights can be determined by a quasi-judicial or investigative body or courts in line with the provisions of the Constitution of the Federal Republic of Nigeria, 1999 (as amended) and the African Charter on Human and Peoples Rights.

“El-Rufai asked the court to declare that by the provisions of Section 36 of the Constitution of the Federal Republic of Nigeria, 1999, the report of the Ad Hoc Committee on Investigation of Loans, Financial Transactions, Contractual Liabilities and Other Related Matters of the Government of Kaduna State from 29 May 2015 to 29 May 2023, as ratified by the Kaduna State House of Assembly, is unconstitutional and therefore null and void for violating his right to fair hearing as guaranteed under the constitution.”

The ad hoc committee set up by the Kaduna State House of Assembly to investigate all finances, loans and contracts awarded under El-Rufai had on June 5, 2024, indicting the ex-governor and some of his appointees of siphoning N423bn state funds.

The Assembly, while adopting the report of the 13-man panel, asked the incumbent Governor, Uba Sani, to refer El-Rufai, his Commissioner of Finance and other aides to relevant security agencies for investigation.

The Assembly had in April set up the 13-man panel, headed by the Deputy Speaker, Henry Danjuma, to probe El-Rufai’s administration.

The probe by the Assembly came weeks after the incumbent Governor of Kaduna State, Uba Sani, lamented that El-Rufai left him a huge debt profile.

Sani, who spoke during a town hall meeting in Kaduna, said he inherited a lean treasury, adding that he could not pay workers’ salaries.

Sani said, “Despite the huge debt burden of $587m, N85bn, and 115 Contractual Liabilities sadly inherited from the previous administration, we remain resolute in steering Kaduna State towards progress and sustainable development.”

While presenting the report during the June 5 plenary, Danjuma said most of the loans obtained under El-Rufai’s administration were not used for the purpose for which they were obtained, while in some cases, due process was not followed in securing the loans.

Receiving the report, the Speaker of the Kaduna House of Assembly, Yusuf Liman, said that a total N423bn was siphoned by the El-Rufai’s administration while leaving the state with huge liabilities.

The committee’s report, which was immediately adopted and its recommendations forwarded to the state Governor Sani for immediate action, alleged that El-Rufai authorised humongous withdrawals of cash both in naira and dollars from the state’s coffers, with no records of utilisation, denying the state of the needed resources for development.

It also alleged that El-Rufai was involved in complicit activities with commissioners and heads of parastatals by allegedly issuing directives to the Kaduna Public Procurement Agency to circumvent due process in the payment of contractors vide letter dated June 21, 2021.

A copy of the report sighted by The PUNCH read partly: “The Governor of Kaduna State between 29th May 2015 to 29th May 2023 as the Chief Executive Officer of the state breached his Oath of Office contained in the 7th Schedule to the Constitution of the Federal Republic of Nigeria (as amended and failed to exercise due discretion in the administration of the state, thereby indulged in: 1. Plunging the state into unwanted, unjustified and fraudulent domestic and foreign debts over and above the total Loans obtained by Kaduna State from 1965 to 1999 and the majority of which were obtained without due process.

“Reckless awards of contracts without due process and due execution, leading to several abandoned projects despite payments.

“(He) authorised humongous withdrawals of cash both in naira and dollar with no records of utilisation and denied the state of the needed resources for development.

“Complicit activities with commissioners and heads of parastatals to defraud the state by issuing directives to KADPPA to circumvent due process in the payment of contractors vide letter dated 21st June 2021.

“Diversion of funds and money laundering contrary to all extant Laws and regulations and accordingly should be referred to the law enforcement agencies for in-depth investigation and appropriate action.”

The committee alleged that some government contractors were overpaid, while others collected money without executing the assigned projects.

It, therefore, recommended that the contractors it listed should refund a total sum of N36.3bn “being funds paid for work either not done, overpayment or diversion to the Kaduna State government.”

The committee equally recommended that the current Commissioner of Finance, the current Chairman of the State Universal Basic Education Board and the current Executive Secretary of the state Pension Bureau should step aside to allow for proper investigation into the activities of the ministry and agencies.

THE PUNCH

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)