...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

The government of Lagos state is not unaware of the reactions of a section of the public on the reviewed land use charge law of 2001. According to statistics, by 2030, Lagos state is projected to become the third largest consumer market in the world with a population of 35.8 million, closely behind Tokyo and New Delhi. Expectedly, high population growth and rapid urbanisation will put infrastructure and public services under enormous pressure. The question is, are we ready? In order to improve on service delivery, increase internally Generated Revenue (IGR), and not depend on the federal revenue, Lagos State has sought to grow its revenue base by ensuring all economic activities on Real estate gives a return to the government for the sole purpose of improving the living conditions of residents of Lgaos State.

The implemented Land Use Charge Law (LUCL) is a repeal of the Land Use Charge Law 2001, it was reviewed by the Lagos State House of Assembly and signed into Law by the Lagos State Governor, Mr. Akinwunmi Ambode on February 8, 2018. The LUCL 2018 which replaced the 2001 law is a merger of all Property and Land Based Rates and Charges in Lagos State

There was an urgent need for the repeal, as the old law had not been reviewed for over 15years, since 2001. Under the old law, the LUC rate was totally inaccurate and retrogressive which deprived the state of keeping track of all economic activities that relates to land in Lagos State.

The new law is a consolidation of Ground Rent, Tenement Rate, and Neighbourhood Improvement Levy. This charge is payable annually in respect of all real estate properties in the state, which means owners and occupiers holding a lease to a Property for ten (10) years or more are now liable to pay the annual LUC invoice charged.

Thus, the Tenement Rates Law, the Land Based Rates Law, the Neighbourhood Improvement Charge and all other similar Property Rates or Charges, Laws or amendments to any such property Laws shall cease to apply to any property in Lagos State as from 2018. Nonetheless, all pending invoices, orders, rules, regulations, etc. under the 2001 repealed Law shall continue to be in effect until such obligations are discharged.

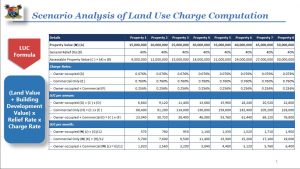

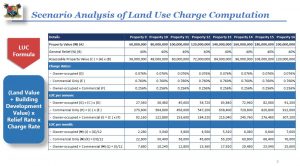

Amount payable is expected to be made from January 1 of every year and can be calculated by multiplying the Market Value (MV) of that property by the Applicable Relief Rate (RR) and Annual Charge Rate (CR). Upon receiving a notice or not, the new law has made it possible for owners to calculate their charge, and enable prompt payment, which allows them to benefit from a 15% discount for early payment, applicable to payments made within 15 days of receipt of Demand Notice.

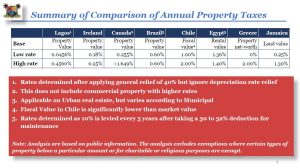

For people saying the use of Market Value should not be the basis for deriving the LUC rate. We ask, what better application should be used? The cost of building houses varies according to area, so each property needs to be valued according to its location, in order to achieve a standardized rate for everyone that is progressive and rational. It is instructive to note that, according to the law, the incidence of payment is on the Landlord and not the tenant.

The State Government has made available some exemptions, which means that after some years of paying your LUC, you may fall under the category of property owners who do not need to pay LUC anymore. This exemption applies to pensioners of 60 years and above who are owners and occupiers of the property.

Other properties exempted include; properties used for public and religious activities, properties used as registered educational institutes and charitable activities, , public cemeteries and burial ground and all palaces of recognized Obas and Chiefs in the State.

Furthermore, various reliefs have been made available to payers, they include a general 40% relief for all property liable to LUC payment, a 10% relief for owners and occupiers with persons with disabilities, a 10% relief for owners and occupiers of 70years and above, a 10% relief for properties above 25years, a 5% relief for properties occupied by their owners for over 12years, a 20% relief for non-revenue generating federal and state government property, and 20% partial relief for non-profit making organizations. To enjoy any of these reliefs, applicants must make claims with evidence for approval to the Lagos State Commissioner for Finance.

Let me demonstrate some scenarios here:…

Also, the ministry has engaged professional services of over 100 registered Estate Surveyors and Valuers who in the next six months will visit various properties to get accurate data for valuation that will be used as the basis for billing for another five years. Owners and Occupiers are expected to provide the officials with valid documents to help with the valuation. The LUC 2018 has been reviewed to enable self-assessment, which means property owners can now make their own calculation and know their rate with the help of professional valuers.

The new law also established an Assessment Appeal Tribunal (LUCAAT) which is authorized to adopt the use of Alternative Dispute Resolution (ADR) in resolving disputes concerning LUC Demand Notice, provided the appeal is lodged within 30 days after the receipt of the Demand Notice. Should any property owner is unsure of his or her LUC bill or assessment, we implore such persons to visit any of our help desks in all the local Government Council Areas or Room 11,Ministry of Finance, Lagos State Secretariat, Alausa, Ikeja or send us an email on luc@lagosstate.gov.ng .We are ready to talk, attend to you and clarify issues on individual basis as tax is a personal affair.

How to pay?

Property owners can pay at any branch of the twenty accredited banks in Lagos State as well as on the available online platforms in the comfort of their homes.

Failure to comply in any form with the LUC Law, obstruct of LUCL officials and/or damage to LUC Property Identification Plaques is an offense punishable under the LUCL.

In order to enable the implementation and enforcement of the new LUC, the Lagos State Government has extended the period for the payment of all annual Land Use Charge Demand Notices for 2018 to April 14, 2018.

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)