...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)

Entertainment and creative sector is about to receive a huge boost, as Heritage Bank Plc, Nigeria’s Most Innovative Banking Service provider has arranged to set aside N5billion as a support funds to drive the industry and stimulate sustainable growth to the nation’s economy.

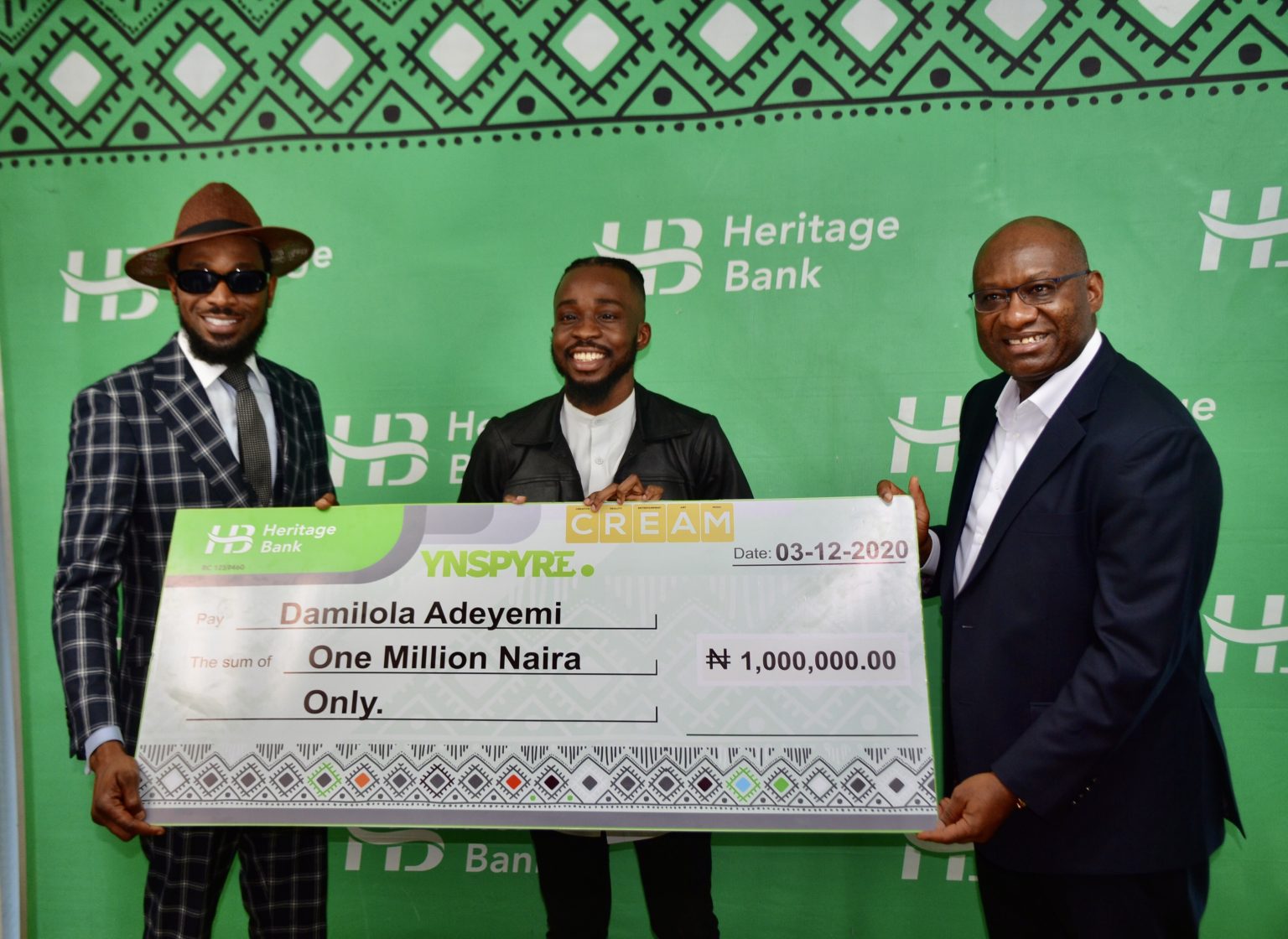

Meanwhile, Heritage Bank doled out the sum of N1million to Damilola Adeyemi, a winner of an online giveaway competition to celebrate the bank’s product, Ynspyre ambassador, Oladapo Daniel Oyebanjo, better known by his stage name D’banj, which heralds launching of the Ynspyre Account set aside for talented young Nigerians in the different spectrum of the creative and entertainment industry.

MD/CEO of the bank, Ifie Sekibo who affirmed Heritage Bank’s commitment to the development and growth of the nation’s creative sector, described the sector as one of the leeway to solving the unemployment occasioned by the prevailing adverse macro-economic environment.

Sekibo, during the presentation of the N1million cheque, said the development and growth of the entertainment industry will get as many people as possible involved as manufacturing, banking and other sectors cannot do it alone.

The bank, in statement, yesterday, signed by the Divisional Head, Corporate Communications of the bank, Fela Ibidapo, assured “the entertainment is going to take a new leaf of life, with the Ynspyre platform; we are hoping to start with this and obviously it will grow to another level. You will see greater things in couple of months.”

Sekibo said the music industry has done so much for Nigeria in terms of employment and foreign exchange earnings and if more resources could be put into it, the country would be better for it.

Besides supporting individual artistes in the industry, the bank has also partnered with some organisers to perform and produce some entertainment shows.

In similar manner, whilst confirming the N5billion set aside for the creative sector and commending Heritage Bank for its numerous bold steps in supporting the industry, D’banji stated, “The reason for setting up this fund is for creative people like me, you (Adeyemi) and the other upcoming artists to have access to it.

“I want to commend Heritage Bank for believing not just in me but the creative industry. Over the years, Heritage Bank has worked behind the scene to sponsor and invest in lots of creativity projects.”

Speaking on the modalities of the product, he disclosed that the Ynspyre Account is the perfect account, specifically created to accommodate and support creative ideas in the industry, which do not need collateral.

“Just open your Ynspyre account, get your proposal ready on what you intend doing in the creative industry; be it music, fashion, lifestyle, IT and others because they have created categories for each and every one of us to enable us assess funds, supports, loans and grants at single digit interest rates,” he explained.

The winner, Adeyemi who disclosed the creative industry had never gotten such spotlight before, said that he was inspired by the cash reward, as the Ynspyre Account product serves as boost to the creative industry.

“Prior to now, artist struggle to get to the level they find themselves either through their personal funds, manager or parents’ funds. Finally, it is actually time for us to shine and the spotlight is on us.

“Big thank you to Heritage Bank for creating this platform, for creating this opportunity, I am so excited. It couldn’t have come at a perfect timing; N1million during Covid-19, it only can be better. I want to thank Heritage Bank for believing in D’Banj and the creative industry, for counting us worthy to invest in us,” he stated.

You can get every of our news as soon as they drop on WhatsApp ...To get all news updates, Join our WhatsApp Group (Click Here)

Also Join our WhatsApp Channel (Click Here)