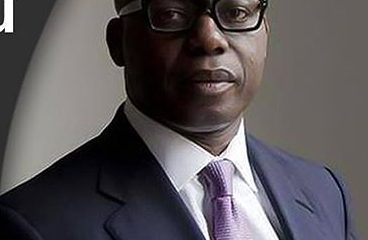

Amid accusations by aggrieved shareholders of attempts to suppress the report of the ongoing forensic audit of its operation, Oando PLC Chief Executive, Wale Tinubu, and his deputy, Mofe Boyo, have been asked to pay Ansbury Investments Inc. about $680 million (about N207.9 billion @ N305.8/dollar).

Ansbury was incorporated in Panama as part of a family trust by an Italian-Nigerian businessman, Gabriele Volpi.

The three-member London Court of International Arbitration (LCIA) presided by David Midon on July 6 gave the partial award against the two embattled top officials of Nigeria’s indigenous oil company.

In the ruling, affirmed by two other co-arbitrators, Marco Frigessi di Rattalma and Harry Matovu, the tribunal upheld Mr Volpi’s application that Ocean and Oil Development Partners (OODP) was indebted to Ansbury by about $600 million (about N183.5 billion).

OODP Limited, incorporated in the British Virgin Islands, controls 55.96 per cent equity in Oando PLC through a holding company, Ocean and Oil Development Partners (OODP) Nigeria Ltd.

The company was established at a time Oando PLC was preparing to acquire ConocoPhillips’ upstream oil and gas assets in Nigeria.

According to a copy of the tribunal ruling sent to PREMIUM TIMES on Sunday by counsel to Ansbury Investment, Andrea Moja, the court also held that Whitmore Asset Management Limited was liable for another debt of $80 million (N24.5 billion).

Whitmore, incorporated in the British Virgin Islands as a single purpose investment vehicle, belongs to Messrs Tinubu and Boyo.

Court documents seen by PREMIUM TIMES showed initial agreement signed on June 17, 2013 gave 60 per cent equity in the venture to Ansbury and 40 per cent to Whitmore.

However, the source of dispute was whether there was a legally binding agreement for Ansbury to transfer 20 per cent share of its equity in the venture to Whitmore, such that OODP BVI equity would change to 60 per cent for Whitmore and 40 per cent for Ansbury.

Besides, the court was confronted with the decision whether the parties made a legally binding agreement to convert an outstanding loan of $150 million (plus interest) into shares in Oando E&P Holdings Limited.

In its ruling, the court said the draft amended loan agreement as well as the draft “Put and Call Option Agreements” never became effective.

“Whitmore is in breach of the repayment obligation in the First Loan Agreement,” the tribunal ruled. “The alleged oral agreement to switch the parties’ respective shareholdings in OODP BVI is not binding on the parties. The alleged oral agreement to extend the term of the loans to 1 January 2020 is not binding on the parties.”

Mr Moja said the final award was expected to follow in the next few days whereby the tribunal would make definite pronouncements on accrued interests on the debts owed and legal expenses.

He said the tribunal’s ruling is in respect of a debt Mr Tinubu is owing, and does not affect Mr Volpi’s status in Oando as its majority shareholder.

He said in line with the tribunal processes, details of the award have since been communicated to all the parties concerned since July 9. The ruling is, however, subject to appeal.

How Crisis Started

In 2012, Ansbury said it invested about $700 million in OODP BVI, by acquiring a 61.9 per cent stake in the firm, with Withmore Limited holding 38.10 per cent.

According to Mr. Volpi, Mr Tinubu approached him to invest in the company at a time Oando PLC was mobilising $1.5 billion to acquire assets in ConocoPhillips’ upstream oil and gas in Nigeria.

Similarly, OODP BVI, which controls 99.99 per cent equity in OODP Nigeria, holds 55.96 per cent of the stakes in Oando.

When the dispute broke out in 2017, Ansbury said it equally petitioned the Nigerian capital market regulatory authorities, the Securities and Exchange Commission (SEC) in May accusing the management of Oando PLC of mismanagement, “insider dealings, manipulation of the company’s shareholding structure and huge indebtedness”.

The petition culminated in the forensic audit of Oando PLC operations ordered by SEC in October 18, 2017.

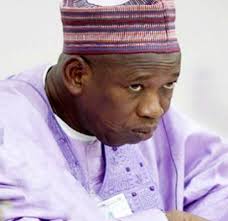

But, the exercise did not take off several months after following the suspension from the office of the former Director General of SEC, Mounir Gwarzo.

MUNIR-GWARZO

Although Abdul Zubair was appointed acting DG to succeed Mr Gwarzo, he was redeployed on April 13 and replaced by Mary Uduk, whom critics say was brought by the minister to do her bidding.

Months after the audit by KPMG commenced, aggrieved shareholders under the platform of Proactive Shareholders Association of Nigeria (PROSAN) accused the management of the company, a fortnight ago, of working with the Minister of Finance, Kemi Adeosun and Mrs Uduk, to frustrate the release of the audit report.

The shareholders blamed the long delay in releasing the audit report on Mrs Adeosun and Ms Uduk’s alleged clandestine activities “to shield Oando management from criminal prosecution”.

“We are calling on the Acting Director-General of SEC to immediately release the report of the forensic audit conducted on the company since last year although we believe the result will be compromised since they have failed to suspend the management of the company while the so-called forensic audit lasted,” National Coordinator of PROSAN, Taiwo Oderinde, said on Sunday in a statement sent to PREMIUM TIMES.

Oando Speaks

When contacted, the spokesperson of Oando, Alero Balogun, said on Monday that she does not have the authority to react to the debt issue.

She, however, Oando or Mr Tinubu’s lawyers would do so at the appropriate time.

Ms Balogun denied the allegation by Oando shareholders that the management was sitting on the forensic audit report.

“We (Oando PLC) are not sitting on any audit report. We went to court to challenge the audit, because we said SEC would not be fair. We lost. Now the the audit has begun and they are saying it is taking too long. We are also waiting for the report of the audit like every other person,” she said.

When PREMIUM TIMES contacted the minister for her response to the allegation she was frustrating the audit, her spokesperson, Oluyinka Akintunde, said his boss had no comment on the allegation.

Mr Akintunde directed this reporter to SEC, which he explained was the agency that ordered the forensic audit.

When this reporter contacted the acting director general of SEC for her response, the acting spokesperson of the commission, Efe Ebelo, assured that Ms Uduk would respond to PREMIUM TIMES’ enquiry.

About a day later, no response has been received from the regulator.

The firm conducting the audit, KPMG, also declined comment on the status.

A representative of the firm, who answered the telephone when the company’s official telephone was called, said KPMG is not obliged to speak to the media on any of its clients’ briefs.

Society6 years ago

Society6 years ago

Society3 years ago

Society3 years ago

Society3 years ago

Society3 years ago

News and Report5 years ago

News and Report5 years ago

News and Report6 years ago

News and Report6 years ago

News and Report5 years ago

News and Report5 years ago